How to Stop Playing Whac-a-Mole with Payments Risk

By Robert Ellenhorn , Solutions & Services, Expertise & Insights, Merchant RiskRemember playing Whac-A-Mole at the arcade? It was fun to pound the moles back into their holes, only to have them pop up again. Now, imagine trying to whack millions of moles. And instead of it being an arcade game, you’re facing a deadly onslaught of illicit substances, dangerous products, and criminal money laundering activities.

Not so much fun, right?

That’s what payment organizations are confronting today as they seek to prevent criminal activities from entering their payment systems. The numbers involved are mind-boggling — for example, according to our database, transaction laundering has seen a massive increase of 30% from 2019.

Illegal activity can get transacted without payment organizations even knowing it. Much of the data to detect money laundering online is hidden and hard to uncover. But here’s the thing: regulators hold them responsible for everything that is sold using their institutions and payment platforms.

CASE IN POINT: THE DANGER OF SIGNAL JAMMERS

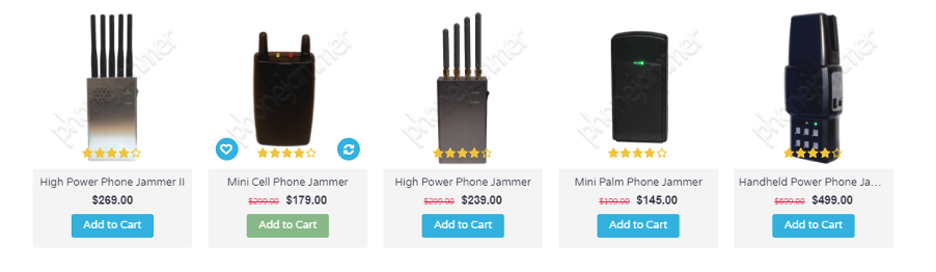

One example of the risks that unwitting payment organizations face can be found with signal jammers. These devices block, jam, or interfere with the transmission or reception of signals by creating interference at the same frequency rates that other devices use.

Most often signal jammers target cell phone signals but they are also used to interfere with signals for GPS and Wi-Fi devices. They can block communications from police or fire departments and can block the use of cell phones in hospitals, government buildings or classrooms.

This means that even “benign” uses of signal jammers can interfere with lifesaving functions and facilitate criminal activities. And with the rise of the Internet of Things, the scope of their interference can now extend to cars, refrigerators, baby monitors, and countless other ordinary items.

ANY PAYMENT ORGANIZATION SELLING SIGNAL JAMMERS RISKS FEDERAL PENALTIES

Given their potential for serious harm, it is not surprising that signal jammers are completely illegal in the U.S. Federal law prohibits the operation, marketing or sale of any type of jamming equipment that interferes with authorized radio communications. Furthermore, the FCC clarifies that there are no exemptions for use within a business, classroom, residence, or vehicle.

In addition to a ban on operating all such devices, it is also important to note that it is unlawful to “advertise, sell, distribute, import or otherwise market” signal jammers to US consumers. This regulatory ban raises serious consequences for payment organizations that are used by bad actors to sell signal jammers.

Any signal jamming device that is marketed or shipped to a U.S. consumer is illegal. And any payment organization transacting these sales — knowingly or not — is at risk of monetary penalties, forfeitures and even imprisonment.

As with most illegal lines of business, merchants selling signal jammers are at high risk of transaction laundering — this also implicates their payment organizations. And the combination of criminal activities (money laundering, human trafficking, selling from sanctioned countries) is now drawing considerable attention from enforcement agencies.

Regulators have escalated their investigations into the use of signal jammers and are now coming down hard on their sales. In fact, two of the nation’s largest credit card issuers were recently contacted by the FCC regarding signal jammers transacted on their sites.

WHAT CAN PAYMENT ORGANIZATIONS DO TO PROTECT THEMSELVES?

There is tell-tale language that online merchants use when engaged in the sale of signal jammers. The devices are generally marketed using language that includes mentions of

- “Spy” equipment

- A number of antennas

- Blocked frequencies (3G, 4G, 5G, Bluetooth, Wi-Fi, GPS, etc.)

- “Protection of privacy,” “quiet in the classroom or church,” and other similar phrasing

Payment organizations can try to identify these bad actors on their own. But the reality is that organizations will never be able to scour the internet closely enough to protect their brands and manage their risks. The only viable strategy for staying ahead of online criminal transactions is to harness the vast powers of machine learning and artificial intelligence.

And this is what EverC provides with MerchantView™. Our advanced technology provides payment organizations with a complete view of their online merchant payment system.

MERCHANTVIEW DOES WHAT NO HUMAN CAN

MerchantView detects and prevents transaction and money laundering activities from entering the payment system. Casting a bright light on the dark corners of the internet, this technology delivers

- World-class automated transaction laundering detection

- Continuous content monitoring across the merchant ecosystem

- Automated insights and merchant risk validation

- MCC detection for identifying the actual line of business of legitimate merchants

- Complete risk profile management that is configurable based on business needs

- Minimal and scalable data footprint; API-enabled with enterprise-level security

By identifying and preventing illicit online activity, MerchantView helps payment organizations reduce and avoid fines, maintain and quickly adapt to regulatory compliance. This, in turn, creates a safer online environment for pursuing legitimate growth opportunities and enables payment organizations to maintain relationships of trust with their customers.

Find out how EverC’s MerchantView can detect risks and protect your business from illegal transactions and money laundering activities. Learn more here.